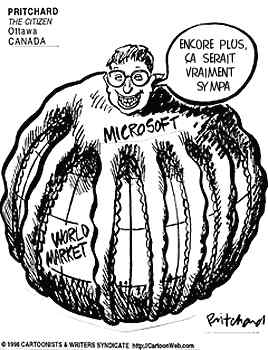

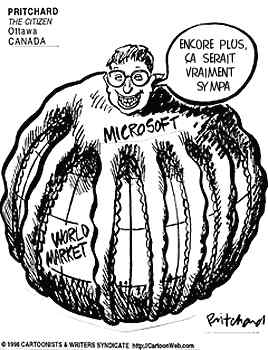

Monopoly, monopoly and more monopolies

Microsoft taking over the world..

Multinationals dominating communication markets....

And the man behind monopoly. HAHA :D

Monopoly, monopoly and more monopolies

On the poverty line

Here's a series of four cartoons gathered from different sources showing the whole story of the Microsoft bid for Yahoo.

1) Market shares of the three companies. Story of the big fish eat small fish and small fish eat plankton.

2)Basically, the loser Microsoft hopes to get the help of the small Yahoo to fight with Google in the search engine and advertising industry.

The story is rather simple and while Microsoft has always been looking for ways to get monopoly power in every single markets that it enters. Unfortunately, Google has a amazingly high market share in search engine as well as the online advertising industry (which generates a lot of revenue at a very low cost). Currently, it is still unclear what form of collusions might happen as Yahoo is looking for ways to work with Microsoft or Google and Microsft is looking for Yahoo or Google. Of course, these three companies have always been trying to differentiate their product by constantly introducing new stuff which shows that in a highly competitive oligopoly market structure, consumer welfare seems to improved.

By the way, after writing this article, i think i might be doing my ilp on the online search engine and advertising industry.

From economist.com

Airlines Struggle to Stay Afloat: ABC News

Hello people! enjoy yo!

The Clean Energy Scam

Thursday, Mar. 27, 2008 By Michael Grunwald. Time Magazine

From his Cessna a mile above the southern Amazon, John Carter looks down on the destruction of the world's greatest ecological jewel. He watches men converting rain forest into cattle pastures and soybean fields with bulldozers and chains. He sees fires wiping out such gigantic swaths of jungle that scientists now debate the "savannization" of the Amazon. Brazil just announced that deforestation is on track to double this year; Carter, a Texas cowboy with all the subtlety of a chainsaw, says it's going to get worse fast. "It gives me goose bumps," says Carter, who founded a nonprofit to promote sustainable ranching on the Amazon frontier. "It's like witnessing a rape."

The Amazon was the chic eco-cause of the 1990s, revered as an incomparable storehouse of biodiversity. It's been overshadowed lately by global warming, but the Amazon rain forest happens also to be an incomparable storehouse of carbon, the very carbon that heats up the planet when it's released into the atmosphere. Brazil now ranks fourth in the world in carbon emissions, and most of its emissions come from deforestation. Carter is not a man who gets easily spooked--he led a reconnaissance unit in Desert Storm, and I watched him grab a small anaconda with his bare hands in Brazil--but he can sound downright panicky about the future of the forest. "You can't protect it. There's too much money to be made tearing it down," he says. "Out here on the frontier, you really see the market at work."

This land rush is being accelerated by an unlikely source: biofuels. An explosion in demand for farm-grown fuels has raised global crop prices to record highs, which is spurring a dramatic expansion of Brazilian agriculture, which is invading the Amazon at an increasingly alarming rate.

Propelled by mounting anxieties over soaring oil costs and climate change, biofuels have become the vanguard of the green-tech revolution, the trendy way for politicians and corporations to show they're serious about finding alternative sources of energy and in the process slowing global warming. The U.S. quintupled its production of ethanol--ethyl alcohol, a fuel distilled from plant matter--in the past decade, and Washington has just mandated another fivefold increase in renewable fuels over the next decade. Europe has similarly aggressive biofuel mandates and subsidies, and Brazil's filling stations no longer even offer plain gasoline. Worldwide investment in biofuels rose from $5 billion in 1995 to $38 billion in 2005 and is expected to top $100 billion by 2010, thanks to investors like Richard Branson and George Soros, GE and BP, Ford and Shell, Cargill and the Carlyle Group. Renewable fuels has become one of those motherhood-and-apple-pie catchphrases, as unobjectionable as the troops or the middle class.

But several new studies show the biofuel boom is doing exactly the opposite of what its proponents intended: it's dramatically accelerating global warming, imperiling the planet in the name of saving it. Corn ethanol, always environmentally suspect, turns out to be environmentally disastrous. Even cellulosic ethanol made from switchgrass, which has been promoted by eco-activists and eco-investors as well as by President Bush as the fuel of the future, looks less green than oil-derived gasoline.

Meanwhile, by diverting grain and oilseed crops from dinner plates to fuel tanks, biofuels are jacking up world food prices and endangering the hungry. The grain it takes to fill an SUV tank with ethanol could feed a person for a year. Harvests are being plucked to fuel our cars instead of ourselves. The U.N.'s World Food Program says it needs $500 million in additional funding and supplies, calling the rising costs for food nothing less than a global emergency. Soaring corn prices have sparked tortilla riots in Mexico City, and skyrocketing flour prices have destabilized Pakistan, which wasn't exactly tranquil when flour was affordable.

Biofuels do slightly reduce dependence on imported oil, and the ethanol boom has created rural jobs while enriching some farmers and agribusinesses. But the basic problem with most biofuels is amazingly simple, given that researchers have ignored it until now: using land to grow fuel leads to the destruction of forests, wetlands and grasslands that store enormous amounts of carbon.

Backed by billions in investment capital, this alarming phenomenon is replicating itself around the world. Indonesia has bulldozed and burned so much wilderness to grow palm oil trees for biodiesel that its ranking among the world's top carbon emitters has surged from 21st to third according to a report by Wetlands International. Malaysia is converting forests into palm oil farms so rapidly that it's running out of uncultivated land. But most of the damage created by biofuels will be less direct and less obvious. In Brazil, for instance, only a tiny portion of the Amazon is being torn down to grow the sugarcane that fuels most Brazilian cars. More deforestation results from a chain reaction so vast it's subtle: U.S. farmers are selling one-fifth of their corn to ethanol production, so U.S. soybean farmers are switching to corn, so Brazilian soybean farmers are expanding into cattle pastures, so Brazilian cattlemen are displaced to the Amazon. It's the remorseless economics of commodities markets. "The price of soybeans goes up," laments Sandro Menezes, a biologist with Conservation International in Brazil, "and the forest comes down."

Deforestation accounts for 20% of all current carbon emissions. So unless the world can eliminate emissions from all other sources--cars, power plants, factories, even flatulent cows--it needs to reduce deforestation or risk an environmental catastrophe. That means limiting the expansion of agriculture, a daunting task as the world's population keeps expanding. And saving forests is probably an impossibility so long as vast expanses of cropland are used to grow modest amounts of fuel. The biofuels boom, in short, is one that could haunt the planet for generations--and it's only getting started.

Why the Amazon Is on Fire

This destructive biofuel dynamic is on vivid display in Brazil, where a Rhode Island--size chunk of the Amazon was deforested in the second half of 2007 and even more was degraded by fire. Some scientists believe fires are now altering the local microclimate and could eventually reduce the Amazon to a savanna or even a desert. "It's approaching a tipping point," says ecologist Daniel Nepstad of the Woods Hole Research Center.

I spent a day in the Amazon with the Kamayura tribe, which has been forced by drought to replant its crops five times this year. The tribesmen I met all complained about hacking coughs and stinging eyes from the constant fires and the disappearance of the native plants they use for food, medicine and rituals. The Kamayura had virtually no contact with whites until the 1960s; now their forest is collapsing around them. Their chief, Kotok, a middle-aged man with an easy smile and Three Stooges hairdo that belie his fierce authority, believes that's no coincidence. "We are people of the forest, and the whites are destroying our home," says Kotok, who wore a ceremonial beaded belt, a digital watch, a pair of flip-flops and nothing else. "It's all because of money."

Kotok knows nothing about biofuels. He's more concerned about his tribe's recent tendency to waste its precious diesel-powered generator watching late-night soap operas. But he's right. Deforestation can be a complex process; for example, land reforms enacted by Brazilian President Luiz Inácio Lula da Silva have attracted slash-and-burn squatters to the forest, and "use it or lose it" incentives have spurred some landowners to deforest to avoid redistribution.

The basic problem is that the Amazon is worth more deforested than it is intact. Carter, who fell in love with the region after marrying a Brazilian and taking over her father's ranch, says the rate of deforestation closely tracks commodity prices on the Chicago Board of Trade. "It's just exponential right now because the economics are so good," he says. "Everything tillable or grazeable is gouged out and cleared."

That the destruction is taking place in Brazil is sadly ironic, given that the nation is also an exemplar of the allure of biofuels. Sugar growers here have a greener story to tell than do any other biofuel producers. They provide 45% of Brazil's fuel (all cars in the country are able to run on ethanol) on only 1% of its arable land. They've reduced fertilizer use while increasing yields, and they convert leftover biomass into electricity. Marcos Jank, the head of their trade group, urges me not to lump biofuels together: "Grain is good for bread, not for cars. But sugar is different." Jank expects production to double by 2015 with little effect on the Amazon. "You'll see the expansion on cattle pastures and the Cerrado," he says.

So far, he's right. There isn't much sugar in the Amazon. But my next stop was the Cerrado, south of the Amazon, an ecological jewel in its own right. The Amazon gets the ink, but the Cerrado is the world's most biodiverse savanna, with 10,000 species of plants, nearly half of which are found nowhere else on earth, and more mammals than the African bush. In the natural Cerrado, I saw toucans and macaws, puma tracks and a carnivorous flower that lures flies by smelling like manure. The Cerrado's trees aren't as tall or dense as the Amazon's, so they don't store as much carbon, but the region is three times the size of Texas, so it stores its share.

At least it did, before it was transformed by the march of progress--first into pastures, then into sugarcane and soybean fields. In one field I saw an array of ovens cooking trees into charcoal, spewing Cerrado's carbon into the atmosphere; those ovens used to be ubiquitous, but most of the trees are gone. I had to travel hours through converted Cerrado to see a 96-acre (39 hectare) sliver of intact Cerrado, where a former shopkeeper named Lauro Barbosa had spent his life savings for a nature preserve. "The land prices are going up, up, up," Barbosa told me. "My friends say I'm a fool, and my wife almost divorced me. But I wanted to save something before it's all gone."

The environmental cost of this cropland creep is now becoming apparent. One groundbreaking new study in Science concluded that when this deforestation effect is taken into account, corn ethanol and soy biodiesel produce about twice the emissions of gasoline. Sugarcane ethanol is much cleaner, and biofuels created from waste products that don't gobble up land have real potential, but even cellulosic ethanol increases overall emissions when its plant source is grown on good cropland. "People don't want to believe renewable fuels could be bad," says the lead author, Tim Searchinger, a Princeton scholar and former Environmental Defense attorney. "But when you realize we're tearing down rain forests that store loads of carbon to grow crops that store much less carbon, it becomes obvious."

The growing backlash against biofuels is a product of the law of unintended consequences. It may seem obvious now that when biofuels increase demand for crops, prices will rise and farms will expand into nature. But biofuel technology began on a small scale, and grain surpluses were common. Any ripples were inconsequential. When the scale becomes global, the outcome is entirely different, which is causing cheerleaders for biofuels to recalibrate. "We're all looking at the numbers in an entirely new way," says the Natural Resources Defense Council's Nathanael Greene, whose optimistic "Growing Energy" report in 2004 helped galvanize support for biofuels among green groups.

Several of the most widely cited experts on the environmental benefits of biofuels are warning about the environmental costs now that they've recognized the deforestation effect. "The situation is a lot more challenging than a lot of us thought," says University of California, Berkeley, professor Alexander Farrell, whose 2006 Science article calculating the emissions reductions of various ethanols used to be considered the definitive analysis. The experts haven't given up on biofuels; they're calling for better biofuels that won't trigger massive carbon releases by displacing wildland. Robert Watson, the top scientist at the U.K.'s Department for the Environment, recently warned that mandating more biofuel usage--as the European Union is proposing--would be "insane" if it increases greenhouse gases. But the forces that biofuels have unleashed--political, economic, social--may now be too powerful to constrain.

America the Bio-Foolish

The best place to see this is America's biofuel mecca: Iowa. Last year fewer than 2% of U.S. gas stations offered ethanol, and the country produced 7 billion gal. (26.5 billion L) of biofuel, which cost taxpayers at least $8 billion in subsidies. But on Nov. 6, at a biodiesel plant in Newton, Iowa, Hillary Rodham Clinton unveiled an eye-popping plan that would require all stations to offer ethanol by 2017 while mandating 60 billion gal. (227 billion L) by 2030. "This is the fuel for a much brighter future!" she declared. Barack Obama immediately criticized her--not for proposing such an expansive plan but for failing to support ethanol before she started trolling for votes in Iowa's caucuses.

If biofuels are the new dotcoms, Iowa is Silicon Valley, with 53,000 jobs and $1.8 billion in income dependent on the industry. The state has so many ethanol distilleries under construction that it's poised to become a net importer of corn. That's why biofuel-pandering has become virtually mandatory for presidential contenders. John McCain was the rare candidate who vehemently opposed ethanol as an outrageous agribusiness boondoggle, which is why he skipped Iowa in 2000. But McCain learned his lesson in time for this year's caucuses. By 2006 he was calling ethanol a "vital alternative energy source."

Members of Congress love biofuels too, not only because so many dream about future Iowa caucuses but also because so few want to offend the farm lobby, the most powerful force behind biofuels on Capitol Hill. Ethanol isn't about just Iowa or even the Midwest anymore. Plants are under construction in New York, Georgia, Oregon and Texas, and the ethanol boom's effect on prices has helped lift farm incomes to record levels nationwide.

Someone is paying to support these environmentally questionable industries: you. In December, President Bush signed a bipartisan energy bill that will dramatically increase support to the industry while mandating 36 billion gal. (136 billion L) of biofuel by 2022. This will provide a huge boost to grain markets.

Why is so much money still being poured into such a misguided enterprise? Like the scientists and environmentalists, many politicians genuinely believe biofuels can help decrease global warming. It makes intuitive sense: cars emit carbon no matter what fuel they burn, but the process of growing plants for fuel sucks some of that carbon out of the atmosphere. For years, the big question was whether those reductions from carbon sequestration outweighed the "life cycle" of carbon emissions from farming, converting the crops to fuel and transporting the fuel to market. Researchers eventually concluded that yes, biofuels were greener than gasoline. The improvements were only about 20% for corn ethanol because tractors, petroleum-based fertilizers and distilleries emitted lots of carbon. But the gains approached 90% for more efficient fuels, and advocates were confident that technology would progressively increase benefits.

There was just one flaw in the calculation: the studies all credited fuel crops for sequestering carbon, but no one checked whether the crops would ultimately replace vegetation and soils that sucked up even more carbon. It was as if the science world assumed biofuels would be grown in parking lots. The deforestation of Indonesia has shown that's not the case. It turns out that the carbon lost when wilderness is razed overwhelms the gains from cleaner-burning fuels. A study by University of Minnesota ecologist David Tilman concluded that it will take more than 400 years of biodiesel use to "pay back" the carbon emitted by directly clearing peat lands to grow palm oil; clearing grasslands to grow corn for ethanol has a payback period of 93 years. The result is that biofuels increase demand for crops, which boosts prices, which drives agricultural expansion, which eats forests. Searchinger's study concluded that overall, corn ethanol has a payback period of about 167 years because of the deforestation it triggers.

Not every kernel of corn diverted to fuel will be replaced. Diversions raise food prices, so the poor will eat less. That's the reason a U.N. food expert recently called agrofuels a "crime against humanity." Lester Brown of the Earth Policy Institute says that biofuels pit the 800 million people with cars against the 800 million people with hunger problems. Four years ago, two University of Minnesota researchers predicted the ranks of the hungry would drop to 625 million by 2025; last year, after adjusting for the inflationary effects of biofuels, they increased their prediction to 1.2 billion.

Industry advocates say that as farms increase crop yields, as has happened throughout history, they won't need as much land. They'll use less energy, and they'll use farm waste to generate electricity. To which Searchinger says: Wonderful! But growing fuel is still an inefficient use of good cropland. Strange as it sounds, we're better off growing food and drilling for oil. Sure, we should conserve fuel and buy efficient cars, but we should keep filling them with gas if the alternatives are dirtier.

The lesson behind the math is that on a warming planet, land is an incredibly precious commodity, and every acre used to generate fuel is an acre that can't be used to generate the food needed to feed us or the carbon storage needed to save us. Searchinger acknowledges that biofuels can be a godsend if they don't use arable land. Possible feedstocks include municipal trash, agricultural waste, algae and even carbon dioxide, although none of the technologies are yet economical on a large scale. Tilman even holds out hope for fuel crops--he's been experimenting with Midwestern prairie grasses--as long as they're grown on "degraded lands" that can no longer support food crops or cattle.

Changing the Incentives

That's certainly not what's going on in Brazil. There's a frontier feel to the southern Amazon right now. Gunmen go by names like Lizard and Messiah, and Carter tells harrowing stories about decapitations and castrations and hostages. Brazil has remarkably strict environmental laws--in the Amazon, landholders are permitted to deforest only 20% of their property--but there's not much law enforcement. I left Kotok to see Blairo Maggi, who is not only the soybean king of the world, with nearly half a million acres (200,000 hectares) in the province of Mato Grosso, but also the region's governor. "It's like your Wild West right now," Maggi says. "There's no money for enforcement, so people do what they want."

Maggi has been a leading pioneer on the Brazilian frontier, and it irks him that critics in the U.S.--which cleared its forests and settled its frontier 125 years ago but still provides generous subsidies to its farmers--attack him for doing the same thing except without subsidies and with severe restrictions on deforestation. Imagine Iowa farmers agreeing to keep 80%--or even 20%--of their land in native prairie grass. "You make us sound like bandits," Maggi tells me. "But we want to achieve what you achieved in America. We have the same dreams for our families. Are you afraid of the competition?"

Maggi got in trouble recently for saying he'd rather feed a child than save a tree, but he's come to recognize the importance of the forest. "Now I want to feed a child and save a tree," he says with a grin. But can he do all that and grow fuel for the world as well? "Ah, now you've hit the nail on the head." Maggi says the biofuel boom is making him richer, but it's also making it harder to feed children and save trees. "There are many mouths to feed, and nobody's invented a chip to create protein without growing crops," says his pal Homero Pereira, a congressman who is also the head of Mato Grosso's farm bureau. "If you don't want us to tear down the forest, you better pay us to leave it up!"

Everyone I interviewed in Brazil agreed: the market drives behavior, so without incentives to prevent deforestation, the Amazon is doomed. It's unfair to ask developing countries not to develop natural areas without compensation. Anyway, laws aren't enough. Carter tried confronting ranchers who didn't obey deforestation laws and nearly got killed; now his nonprofit is developing certification programs to reward eco-sensitive ranchers. "People see the forest as junk," he says. "If you want to save it, you better open your pocketbook. Plus, you might not get shot."

The trouble is that even if there were enough financial incentives to keep the Amazon intact, high commodity prices would encourage deforestation elsewhere. And government mandates to increase biofuel production are going to boost commodity prices, which will only attract more investment. Until someone invents that protein chip, it's going to mean the worst of everything: higher food prices, more deforestation and more emissions.

Advocates are always careful to point out that biofuels are only part of the solution to global warming, that the world also needs more energy-efficient lightbulbs and homes and factories and lifestyles. And the world does need all those things. But the world is still going to be fighting an uphill battle until it realizes that right now, biofuels aren't part of the solution at all. They're part of the problem.

------------------------------------------------------------------------------------------------

This is a pretty interesting article that actually challenged the assumption that biofuel can act as the alternate source of fuel. Basically, biofuel usage has caused multiple problems (if u got read some article on straits times some weeks ago)to the human being. The root of the biofuel problem actually lies in the farmer and us.

Two main reasons why farmers switch to produce corn(source of biofuel):

Total profit= Total revenue -Total cost. Therefore, as revenue rise and cost droping, it will be rational for farmers to switch to corn production

Impact

One impact will be clearing more lands for corn production which actually leads to the worsening of global warming (An irony).

HOWEVER, the worst impact is how it actually "helps" in driving global food prices up. Demand increase for biofuel->Increase in supply for corn->Decrease supply in land for other agricultural produces->Decrease supply of your grain, soybean and etc->Increase in equilibrium price of your food. An amazing chain effect but it has been one of the key factors for the rise in food prices other than the falling US Dollar driven investment.

Conclusion

BIOFUEL IS NOT THE SOLUTION BUT JUST ANOTHER NEW PROBLEM WE HAVE CREATED FOR OURSELVES.

Oil sets record near $128; pump price at high, too