Thursday, July 3, 2008

Monday, June 30, 2008

Malaysia Airlines' rising fuel surcharge

Just read something excting, MH is rising its fule surcharge by up to 80%. Considering the fact that MH is rated 5-star by Skytrax. Though it is way below the benchmark set by SQ in terms of AVOD and amenities.

Read on:

Malaysia Airlines sharply raises fuel surcharge for international routes

The Associated Press Published: June 27, 2008

KUALA LUMPUR, Malaysia: Malaysia Airlines on Friday sharply raised fuel surcharge for international routes, and warned that surging world oil prices would lead to increasingly higher fares worldwide for air travel.

The fuel surcharge increase range from as low as 25 percent for short haul regional flights and up to 80 percent for long haul sectors, the national carrier said in a statement.

Flights to and from China have been exempted from the fuel surcharge hike for the time being, it said. It gave no reason.

Managing director Idris Jala said the price of jet fuel — which accounts for about 40 percent of operating expenses — has shot up by 80 percent since last year to an average US$166 a barrel.

The airline managed to remain in the black but its net profit in the first quarter fell by almost a tenth from a year ago to 120 million ringgit (US$37.5 million), he said.

Today in Business with Reuters

As U.S. housing bill evolves, crisis grows deeperOne rebate for U.S. consumers isn't enoughA conflict of interest in Wall Street's marketing of securities

"We will face more pressure in the near future. We have no choice but to raise fuel surcharge and fares," Jala said. "For the time being, we are not going to impose an additional fuel surcharge on the domestic sector. But we may have to if the oil price continues to rise."

He said the revision was done on a route-by-route basis to ensure the company remains competitive.

For instance, fuel surcharge for a one-way trip from Kuala Lumpur to London is now up 23 percent to 736 ringgit (US$230) and to Sydney by 44 percent to 608 ringgit (US$190).

For international travel involving connections in Kuala Lumpur, fuel surcharge have been raised by between 46 and 60 percent.

Jala said Malaysia Airlines may have to cut capacity and will continue to cut costs and be more creative in its operations — including offering low fares on excess capacity — to survive the crisis.

"Despite all of this, cost cuts and innovation can only do so much. One thing remains crystal clear: The world must adjust to higher oil prices and that means higher price of air travel too," Jala said.

"The general public everywhere must be prepared to face sharply higher prices for air travel now, or be prepared to stomach even higher prices later when the number of participants become fewer and competition fizzles out in favor of consolidation. Airlines cannot continue to subsidize passengers any more," he said.

Jala said the fuel bill for the global aviation industry is expected to soar 29 percent to US$176 billion this year if oil prices averages US$107 a barrel. This will push the industry into the red with a loss of US$2.3 billion, he said.

If crude oil stays at US$135 for the rest of the year, losses will be much worse at US$6.1 billion, he said.

"These are indeed difficult times and call for drastic changes in the way we do business," he said, warning that air fares may rise on average by as much as half as airlines seek to mitigate fuel cost.

May SQ rule forever,

liuhao.

Sunday, June 29, 2008

Price Discrimination (case of SIA)

Basic Idea of PD: The practice of charging different people different prices for the same goods or services when such difference does not result from cost factors.

Case Study: SQ route from Singapore to Los Angeles via Narita SQ11/12

Forms of PD

1) Bulk Discounts given to travel agents e.g. Fortune Travel. For example, booking directly for a return flight from Singapore to Los Angeles via Narita on SQ11 costs $3209.00 inclusive of tax (ref: http://www.singaporeair.com/saa/en_UK/Pricing/FlightReview.jsp) while when you book with Fortune Travel costs only $2800.00 inclusive of tax (after calling their hotline)

2)Student Prices. For the same route on SQ, if you are a student travelling to L.A. for studies, tickets can be purchased at 1300.00 incl. tax for a single trip while when booking online for this single trip, it costs 1822.00 inclusive of tax. (First degree PD)

3) Prices Vary by location. Again for the same route on SQ, the return flight can be booked at $3209.00 while if you call the SQ agents in the states, they charge the same flight at 2500 USD which is approx 3400.00 SGD. Thus location wise matters too. (3rd degreee pd)

Additional Information:

SQ27/28 which flies from Singapore to Los Angeles via Taipei will terminate in 2008 due to the introduction of a whole new excutive economy class flight (luxurious service: due to rising income of travellers) which flies direct to LAX (SQ 38). Incidentally, this SQ 27/28 flight was previously the infamous SQ006 which tarnished SQ's image when it crashed at Taipei Taoyuan in 2000. It was renamed SQ 27/28 since.

Hope you enjoy it

liuhao

Sunday, May 25, 2008

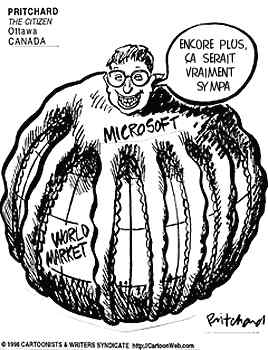

Monopoly, monopoly and more monopolies

Microsoft taking over the world..

Multinationals dominating communication markets....

And the man behind monopoly. HAHA :D